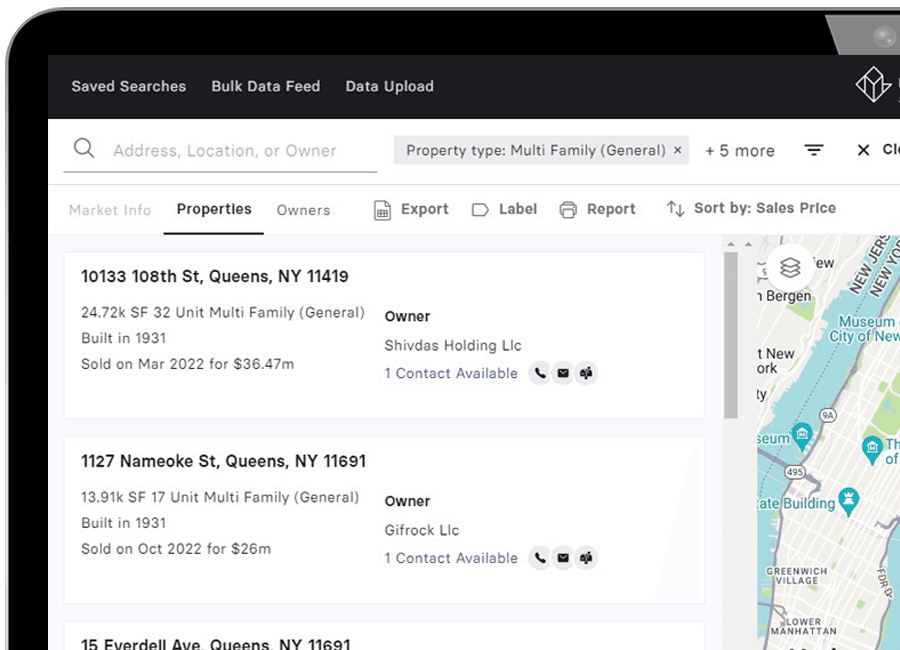

Unlock CRE intelligence

Powered by AI and machine learning, Reonomy is where CRE opportunities are discovered and data-driven decisions are made.

54M+

commercial properties

68M+

property transactions

5.2M+

companies

30M+

owners and contact records

loading...

Get started today

Signing up for Reonomy free trial is the fastest and most efficient way to start using Reonomy.

However, if you would like to understand the full capabilities of the Reonomy web app, our data solutions or get a better understanding of the broader offerings delivered by Altus Group, our sales team would be happy to guide you.