How to find commercial mortgage leads

A look at some surefire ways that commercial loan officers, brokers, and lenders can generate and win new business.

Whether you’re a mortgage broker, loan originator/officer, or commercial lender of any kind, the ability to generate commercial mortgage leads on-demand opens your doorway to success. The thing is, generating commercial real estate leads of any kind can be a strenuous, time-consuming process. And given the time-sensitive nature of connecting with owners in need of financing, loan leads are especially difficult to gather effectively.

Throughout this article, we’ll cover the 6 best ways to generate commercial mortgage leads - including how to do so in a matter of seconds.

Commercial loan leads

The first step in effective mortgage lead generation is understanding your audience. So, in commercial real estate, what types of loan leads are there?

There are two types of loan leads:

New mortgage leads

Mortgage refinance leads

Types of commercial loan leads

On a broad level, the breakdown is pretty straightforward: there are owners looking for new financing, and owners looking for refinancing.

New mortgage leads

On one side of things, there are those looking to buy commercial property, that are therefore looking for new property financing (or will be looking in the near future). Those in search of a new mortgage will be looking on behalf of their own use—say, a small business loan—or for investment/development purposes.

Mortgage refinance leads

Refinance leads will be owners looking to rework the existing debt that they have on a commercial property. These owners could also be looking to buy new property—say a small business looking for cash-on-hand to expand their operations, or an investor/developer looking to expand their portfolio. Whatever the case may be, finding the property debt research tools that bring in leads of high value will make each subsequent part of the deal-making process more effective.

How to generate commercial loans leads

In the past, companies offering financing to commercial owners would typically generate leads through referrals, marketing, or by tracking down mortgage records that pointed to potential new business. Proactively tracking down leads from scratch, however, was next to impossible. Debt and mortgage data are now much more accessible, and so you can actually seek out and find mortgage leads in your market in a matter of seconds.

Let’s look at how that’s possible.

Find refinance leads with Reonomy

The Reonomy web app gives mortgage brokers and originators the highest level of access to mortgage data, property owner details, and owner contact information.

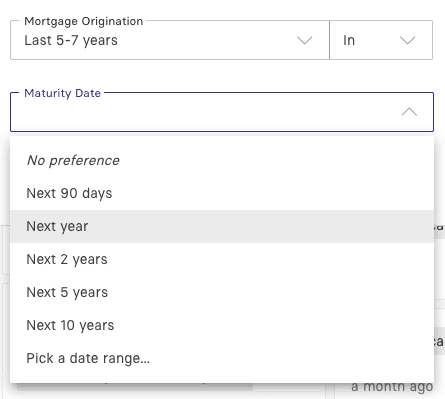

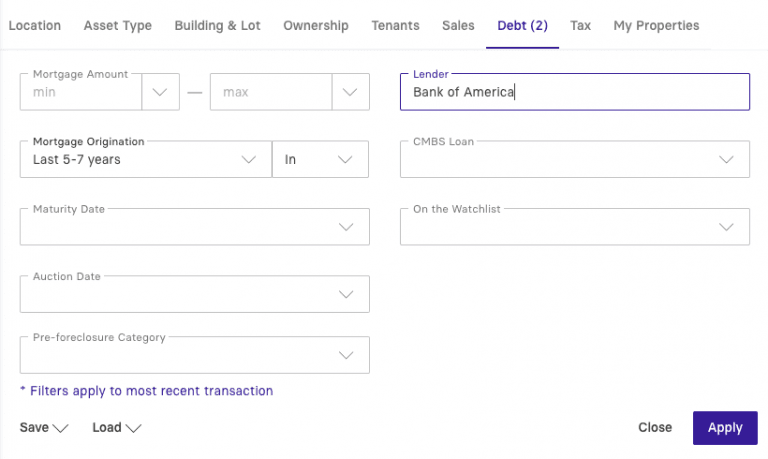

Refinance leads can be identified by analyzing sales history, loan history, surrounding and comparable properties, CMBS data, as well as by property location, asset class, and building and lot sizes. Find Leads by Mortgage Origination and Maturity Dates: When it comes to commercial mortgage leads, timing is everything. With Reonomy, you can search for properties that have mortgage origination or maturity dates within a specified time frame (as in, you can see owners who are likely coming to terms on their current mortgage).

You can also narrow down searches by the name of the lender, CMBS loan details, pre-foreclosure stage, and the dollar amounts attached to mortgages and sales. Find Leads by Lender: Also included in the mortgage history of a property are its previous and current lenders. To search for commercial properties that have mortgages with a specific lender, simply enter a name into the “Most recent lender” search bar and click “Apply.”

Find Leads by Mortgage Amount: If you typically work with mortgages of a certain size, you can also identify leads by their previous mortgage amounts.

To do this, you can add a range of numbers to the “Most recent mortgage amount” filter within the Debt tab of Reonomy’s search platform. Identify CMBS Loan Information: You’re also able to see specific CMBS loan information on

Property Lien Search: Another way to qualify potential leads online is by searching for properties that have a lien on them.

By taking accurate ownership information from Reonomy and using it to inquire with the county clerk’s office, you can find out whether a commercial property has a lien, and therefore whether or not the property qualifies as someone you’d want to pursue.

Find Properties in a Specific Location: You can identify commercial mortgage leads within a confined geographical region—from a city, to a county, neighborhood, or street.

Find Mortgage Leads by Property Type: Another broad-level way to generate mortgage leads is to by property type.

If you’re a mortgage broker that specializes in multifamily financing, for example, you can run a search for multifamily properties, then look at the mortgage history of individual properties (as mentioned above).By sifting through your desired market for targeted asset types and loan specifics, you can identify valuable leads very quickly.

Search public mortgage records

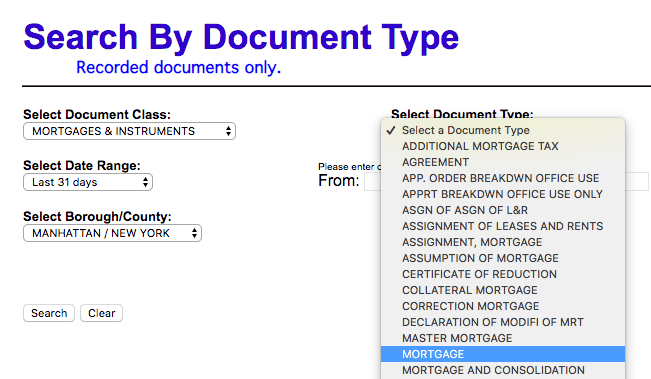

While a bit harder to find compared to property sales records, another way to find prospects is to access mortgage history via online public records. Perhaps the most prominent, most reliable example of this is ACRIS, New York City’s public property records database. On the ACRIS website, you can choose to “Search Property Records,” then choose to search by document type, for which you can select “mortgage” or any other debt-related document types.

While ACRIS may be the most notable example of public mortgage records, there are a number of smaller, local sites nationwide that allow you to search through public mortgage records on commercial properties. To generate leads from these sites, you can search for properties within very specific locations and see if they have recent sales and mortgage documents available.

If so, you can see whether those properties have a mortgage likely coming to terms in the near future.

Social media marketing

Notable resources:

For sustainable online lead generation, staying active with your own website and social media channels is crucial. Social media ads are a great way to build awareness and quickly prove your expertise in the market. By informing your ad copy, targeting, and ad timing with in-depth property and owner data, social media ads can be a terrific source of mortgage lead generation. Facebook allows advertisers to find their audience based on layers of targeting, including demographic, location-based, interest-based, and behavioral targeting.

That, plus the variety of ad types available on Facebook, make it a very flexible tool that can help you reach a large amount of engaged, relevant leads. LinkedIn is also a tremendous social platform for commercial debt professionals. In fact, according to Hubspot, LinkedIn is 277% more likely to generate leads compared to Facebook and Twitter.

LinkedIn is a great way to maintain industry connections while creating new ones through paid advertising. By staying involved and communicating with others in your market, you can create lasting brand awareness, while building your referral network. Furthermore, with LinkedIn’s self-service paid advertising, you can target users by their job title, industry, and more. You can combine targeted ads with industry, role, and market-specific data to stick out amongst the rest. Social media platforms are also great places to share your own website content (more on that below).

Content marketing

One of the best long-term, sustainable lead generation tools is your very own website. Your own content will be the main driver of inbound lead generation. Content marketing is an increasingly important medium for commercial real estate professionals, and when done correctly, can serve as a tremendous source of already-engaged mortgage leads.

Content that ranks organically drives a high volume of traffic to your site, and therefore can bring generate a high volume of leads.

Furthermore, by sharing your content across your social media pages, you can build your online persona even further, increasing brand awareness, and widening your net of lead generation. Web content that is properly optimized for search engines will continue to generate leads, as well.

Your content should have timeless topics that present clear value to your target audience.

There are two parts to building a content strategy that generates leads. The first part is to make sure that your content is informative. Instead of just selling your own products, make sure to include added information-value in the content you produce. Prove your expertise in the industry to build credibility. Your content should also be data-informed.

The only way to truly understand your audience, the market, and your target audience’s engagement with your previous content, is to continuously analyze relevant data trends using tools like HubSpot and Google Analytics.

Buy mortgage leads

You also have the option to simply buy leads from other brokerage firms and lenders. These are typically known as trigger leads. Essentially working as “leads on demand” for brokers and originators, it allows you to have leads at all times.

The issue with buying real estate leads, however, is that they are often expensive, and lack the level of targeting currently available to brokers and originators elsewhere.

As data has become more widely accessible, brokers and originators can now find and target hyper-specific leads based on many layers of qualifying characteristics. Lenders that sell leads will often segment by those in need of refinancing, but cannot segment based on the granular needs of individual brokers and originators.

Despite the higher costs, this can also lead to much lower conversion rates. With such high levels of data available across the industry, the need for brokers and originators to buy real estate leads is shrinking.

Visit the county clerk/recorder

If you’re looking to generate mortgage leads offline, the county recorder or assessor’s office is where you’ll find the most accurate, reliable information to source prospects. Despite the time needed to do so, paired with online resources, gathering information in-person can still be useful to fill data holes and double check other data sources.

How to convert mortgage leads

Finding commercial loan leads is one thing, but once you have your list, converting them into clients requires you to present a new level of depth and value in your marketing efforts. Converting leads into clients is merely an extension of your lead generation efforts, and is the point where you can begin to build a true rapport with leads. Two great ways to nurture and convert leads are through email marketing and direct mailers.

Email marketing

Notable resources:

Building an engaging email marketing strategy can also bring in very engaged mortgage leads. By searching within Reonomy (as mentioned above), you can find owner contact information, including phone numbers, mailing addresses, and email addresses, to connect directly with property owners.

You can send cold emails to those owners using information gathered on Reonomy about them, their portfolio, their mortgage history, and the market they’re in. This very same logic could be applied to commercial real estate cold calls, only the application of the information will take on a slightly different, more verbal form.

Marketing postcards

Notable resources:

Commercial real estate postcards are physical marketing collateral for debt professionals. And just like your social media, content, and email marketing efforts, postcards can be customized to match the singular needs of individual property owners. By combining templates from the likes of Postcards.com or MyCreativeShop with in-depth property, owner, and market data from Reonomy, your marketing postcards could end up generating more commercial mortgage leads than some of your online marketing efforts.

No matter where your mortgage lead generation efforts are taking place, with the right data from Reonomy, all of your efforts can be delivered at the exact right time, to the right person, in the right place. For commercial debt professionals, timing is nothing short of essential.

Author

Reonomy

Resources team

Author

Reonomy

Resources team