A look at the best commercial real estate valuation approaches

For appraisers and investors, being able to accurately determine the value of a commercial property is crucial.

Whether on an individual basis or in aggregate, understanding property values is an essential for any business working with commercial real estate in any capacity. In most cases, your team’s ability to determine property values comes down to the commercial data it has in-hand—especially when reviewing values in-aggregate. On an individual basis, there are a few different methods you can use to determine and double-check the value of any commercial asset. Here, we discuss each in detail.

Commercial real estate valuation

Commercial real estate valuation is fairly different than residential. The heightened value and added intricacies make the valuation process a much more complicated beast. Below, we dive into the best approaches for finding commercial real estate values.

Reonomy: The sales comparison approach

The “sales comparison approach,” often referred to as the “market approach,” is the appraisal technique used heavily in residential real estate, though is often used in commercial real estate valuation as well.

This method relies on looking at comps and recent sales data to help assign a value to the property in question.

Traditionally, the challenge with using the sales comparison approach in commercial real estate was that finding comps could be difficult. Sometimes, in order to find a comp, the appraiser may have needed to look well outside of the market area, which wouldn’t make for very reliable comparisons. Demographics, leasing trends, access to infrastructure and more may look very different outside of the market area and all can have an impact on the value of the property.

With Reonomy’s powerful property intelligence, however, finding a lengthy list of comps is now easier than ever. Reonomy harnesses the market’s largest database of off-market properties (including those listed and unlisted). In turn, you’re empowered to quickly finding opportunities in any market, uncover strategic property-related insights and connect with decision-makers.

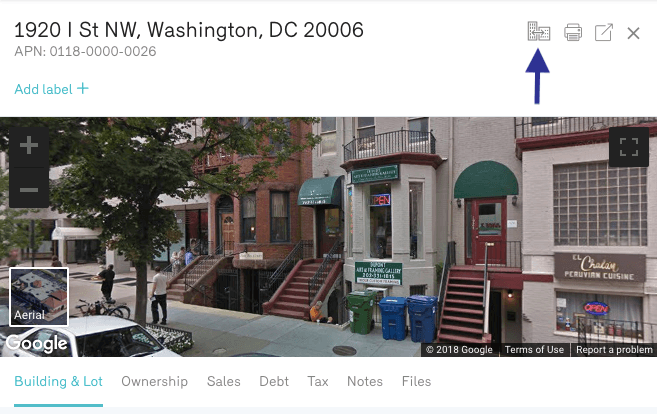

More importantly, it makes finding comps a breeze. To find comps using Reonomy, begin by running a property search for your target asset. That could mean searching for an asset type within a specific geographic delegation, or it could mean searching for a specific individual property.

See how to run a property search here. Once you have identified the target property that you’d like to find comps for, simply click the “View Comparables” button present on the property’s profile page.

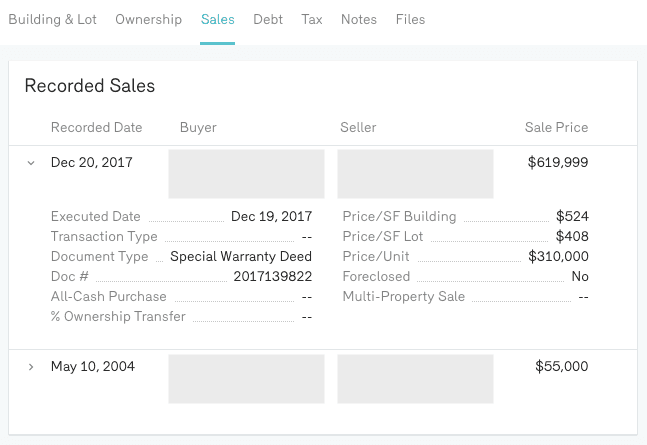

Upon clicking the icon, you’ll be given a list of comparable properties to that of your subject property. From there, you can enter into any of your comparable properties, and view their sales history in the Sales tab of the profile page.

Reonomy real estate comps are based on many data points, only including factors that would equate to a very valuable comparison. By analyzing the sales history of recently sold properties, you’ll be able to pinpoint a very accurate valuation of a commercial value of any asset type, in any market nationwide.

The cost approach

Another approach is the cost approach. The “cost approach” calculates what it would cost to rebuild the property from scratch. This accounts for the current cost of the land, construction materials, labor costs and more that would be associated with replacing the commercial property’s existing structure(s).

In short, this method assumes the value of the commercial property is equal to the cost incurred to re-construct it. The cost approach uses a very simple formula:

Property Value = Land Value + (Cost to Build New + Accumulated Depreciation)

This approach assumes that informed buyers would not spend more for a commercial property than they would be willing to spend on acquiring land and building the same property from scratch (aka “Costs to Build New”).

Costs to Build New can be calculated a number of ways:

The comparative unit method calculates a lump-sum estimate for the costs to build new on a per square foot basis, looking at different categories of construction materials (e.g., steel frame vs. concrete frame, interior or exterior load bearing walls).

The segregated cost method calculates the individual cost of various building components, such as the cost to build a new roof, the cost of new HVAC systems, and so forth.

The unit-in-place method takes the segregated cost method to the next level by breaking down building components even further. For instance, it would analyze a roof not as a whole structure, but rather in terms of the individual pieces of the roof like joists and decking plates.

The quantity survey method is generally considered the most accurate form of determining cost, but it’s also the most time-intensive method. The quantity survey method includes a detailed estimate for each building component and material down to the exact quantity needed to replicate the structure, and then adjusts for labor and other overhead accordingly.

Accumulated depreciation can be calculated using the straight-line method, which in commercial real estate, depreciates an asset equally over a 39-year period (per IRS guidelines). An alternative way to calculate accumulated depreciation is by doing a cost-segregation study, which looks at the lifespan of individual building components, allowing depreciation to be front-loaded instead of equally over time. The cost approach isn’t used very often, but it is most useful when a property is located in a less-than-active market where the data to feed the alternative approaches can be hard to come by.

The income approach

The income approach is the most frequently used appraisal technique when it comes to valuing a commercial real estate asset. The approach is based on how much income a property is expected to generate in the future. In order to calculate the value using the income approach, you must first understand a few key commercial real estate concepts: net operating income (NOI) and capitalization rate (“cap rate”).

NOI is the net income generated by a property, less operating expenses but before capital expenditures, debt service and taxes. In other words:

NOI = Effective Gross Income – Operating Expenses

The cap rate is a ratio of net operating income to a property’s value and is used to express an owner’s anticipated return on investment over the course of a year before factoring capital costs, debt service and taxes.

Cap Rate = NOI / Value

Or otherwise stated: Value = NOI / Cap Rate.

To value commercial real estate in this way assumes the owner, or appraiser, has access to or can create a pro forma that shows the anticipated stabilized NOI. A cap rate is then assigned to the equation. In some markets, particularly more active commercial real estate markets like San Francisco and New York, most investors are accepting 3-4% cap rates at this point in the market cycle. In other markets, like Cleveland or Tampa, for example, a 6-8% cap rate might be more standard.

One of the pitfalls of this approach is that individual investors have a different tolerance for cap rate thresholds.

The benefit of this approach, though, is it allows an investor to determine what he might be willing to pay for a property. For instance, assuming “X NOI / my acceptable cap rate,” I’m willing to pay Z for this asset. The income approach is one of the most accurate valuation methods, but with a caveat: the inputs into calculating NOI must be highly accurate. If someone miscalculates rents or underestimates vacancy rates, for instance, the resulting numbers would be skewed.

The gross rent multiplier approach

The “gross rent multiplier (GRM)” approach is an alternative, simpler approach to valuing commercial real estate. It’s really a back-of-the-envelope calculation that takes the price of the property and divides it by the gross income to estimate a potential valuation. This is a quick and dirty way of identifying commercial real estate assets that have a low price compared to their market-based potential.

Here’s a simple GRM example.

Property Value = Annual Gross Rents x Gross Rent Multiplier

$1,280,000 = $160,000 x 8 (GRM)

In this example, using a GRM of 8, a property that generates $160,000 per year in gross rental income would be valued at roughly $1.28 million. The biggest difference between the income approach and the GRM approach is that the former uses the net income in its calculation of value, whereas the latter relies on gross income.

Valuation is driven by information

As you can see, there are multiple ways to value commercial property. Truth be told, an appraiser typically uses more than one approach and then takes an average of the approaches to determine the value of a property. It’s important for any real estate investor or appraiser to understand the key inputs into these equations to truly understand the value of a property. There’s a bit of a learning curve associated with appraisals, but each time you calculate a property’s value it gets easier.

Author

Reonomy

Resources team

Author

Reonomy

Resources team