How to find motivated sellers of off-market properties

Identifying sellers can seem like a hurdle to going off-market—here, we're going to show you why that shouldn't be the case.

The current state of the business world can seem a bit unsettling even for seasoned professionals who have been around the block a few times. After all, the COVID-19 pandemic has left much of the country in a state of lockdown.

Equipped with the right strategy and tools, however, real estate brokerages, investment firms, and other service organizations can continue prospecting for new business and close deals.

So, what is the right strategy? During economic downturns, off-market deals become much more important and prevalent. Therefore, acquisition teams should focus on identifying motivated sellers off-market instead of sourcing deals the traditional way.

And if you think this sounds easier than it is, think again. With the right tools, finding sellers and landing off-market deals is no longer a challenging task.

Amidst COVID or not, Reonomy’s property intelligence platform can help your team discover assets by type, quickly identify if a property is likely to sell, and see exactly who the owners are and their contact information.

Motivated sellers of off-market real estate

There are a number of commercial owners that are eager or willing to sell; they simply haven’t listed their property or connected with an agent yet.

While this group represents an immense business opportunity for brokerages, institutional investors, mortgage underwriters, and other industry service providers, identifying which owners are actually interested in selling (and why) wasn’t always easy.

Today, your business development team can simply use Reonomy’s new Likely to Sell feature, which combines machine learning with more than 30 years of sales data to algorithmically predict which properties have a high likelihood of selling within two years. Using this feature in combination with Reonomy’s numerous other filters will allow you to quickly source new, targeted off-market opportunities across one or multiple markets.

How to find off-market deals with Reonomy

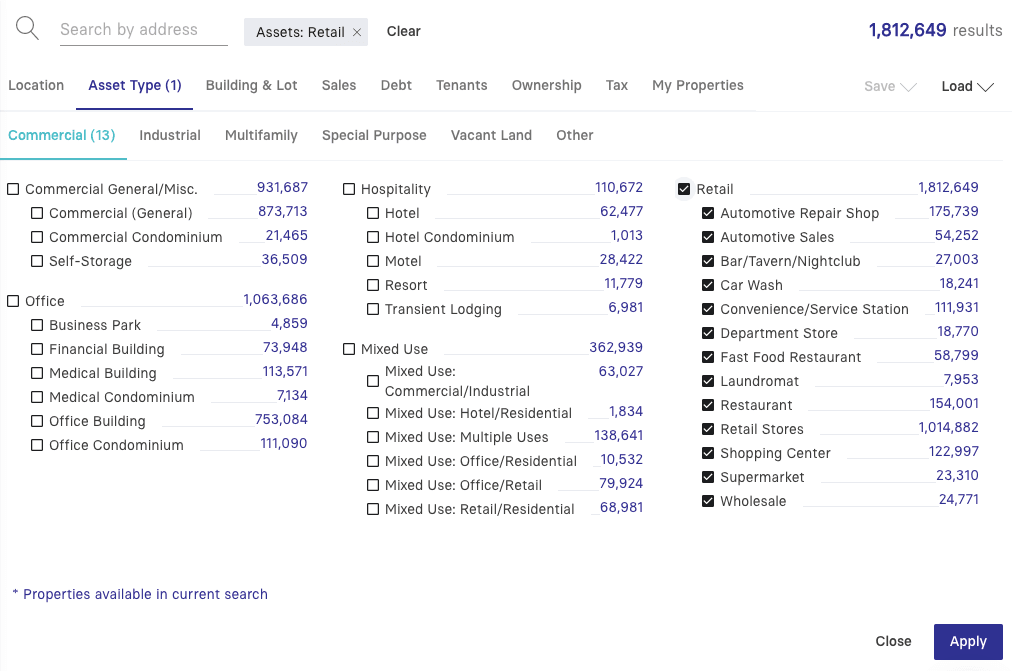

In addition to the Likely to Sell feature, Reonomy offers filters based on geography, asset type (and sub-types), and owner details.

Furthermore, the platform allows you to filter the market for properties by:

Most recent sale date and amount

Most recent mortgage amount

Loan origination and maturity dates

Building and lot size

Tenants

Tax assessments

This robust filtering functionality can power up your organization’s entire market analysis, help you identify assets that are likely to sell, and get in direct contact with property decision-makers.

Let’s run through a few high-level examples. The best approach is to start with identifying the location and asset type of your desired acquisition.

Reonomy can help you find potential sellers of all types of real estate and across any market. For example, if a REIT is looking to enter the multi-family residential market in large metros in the southern U.S., it would make sense to search for owners of multiple multi-family apartment buildings in cities like Atlanta, Dallas, Miami, etc.

Find sellers by sales and loan history

Another search feature that may be especially valuable to investment firms and lenders, is property sale and debt history. One option offered by Reonomy is to search for properties coming to term on loans. If an owner is due to refinance, they may choose to sell their property instead. Another option would be to search for recent sellers and buyers. Reonomy allows you to search owners by name to uncover their portfolios. An owner who recently sold an asset may be looking to sell off additional properties.

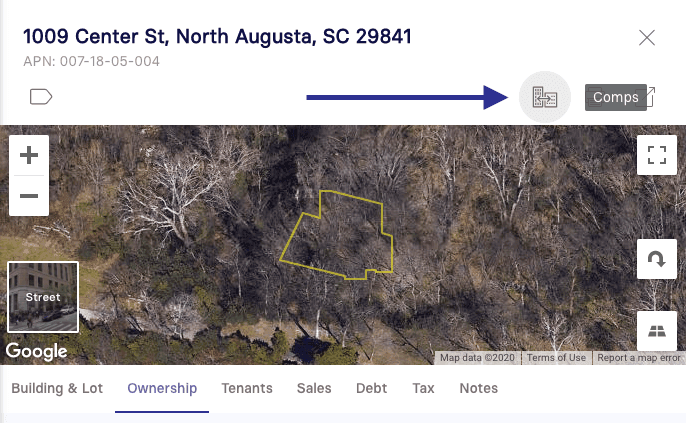

Find sellers with Reonomy comps

If your firm is looking for multiple acquisitions in a specific market, you can start by identifying a single property of interest, and then view its comparables to find other similar assets. What you might do is look up a property matching your criteria, or even a property already in your portfolio, then simply click Reonomy’s “Comps” button, which will take you to a list of comparable assets.

Comps are used to understand asset values, but can also be helpful in spotting additional opportunity that falls within your typical scope.

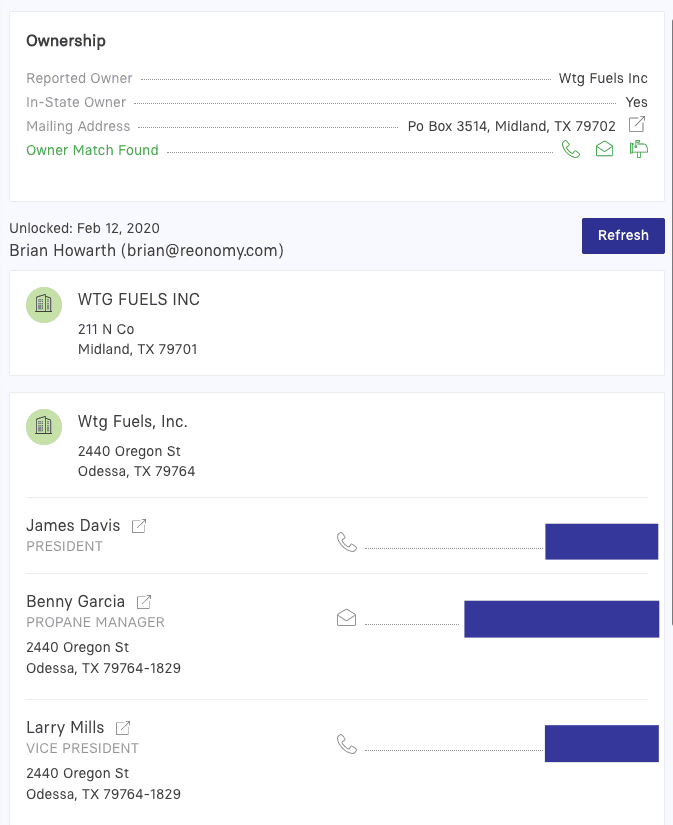

Getting in touch with off-market sellers

Reonomy’s property intelligence tool increases the probability of finding new prospective sellers off-market. It can also help your company (A) craft a much stronger pitch with the information you’ve discovered, and (B) get in touch directly with decision-makers. Reonomy gives you full access to property owner contact information, including phone numbers, email, and mailing addresses.

Depending on your criteria, you might be able to identify a number of promising opportunities quickly, but there is no guarantee. Given the off-market scenario, any potential turmoil in the market may cause property owners to hold off temporarily or change their minds about selling altogether.

Nevertheless, it is important to keep a roster of all potential sellers, as many will have a future interest in finding a buyer for their commercial property. Developing relationships with owners wherever possible may result in a number of successful acquisitions down the road.

Establishing relationships over the long term is powerful for business growth. The best way to start these relationships is with direct contact.

Access to owner contact information is a large piece of the puzzle when it comes to sourcing and landing off-market acquisitions. If your team is unable to get into direct contact with a decision maker, their outreach time will not be spent very productively. The Reonomy platform can make that process a little easier to navigate.

Next, let’s talk a little bit about motivated sellers and some of the reasons why they may be open to the prospect of selling their property.

Motivating factors for sellers

Not every property owner will be looking to sell off-market, so there will be many individuals who will not be responsive if you were to reach out to them. If your outreach is more targeted however, you will encounter far fewer negative responses. Here are some scenarios that may cause a property owner to consider selling their real estate assets:

Business owners in need of newer or larger buildings

Owners approaching loan maturity

Long-time owners looking to retire or lessen their management load

Owners in distress

Approaching individuals in one of these situations will increase your chances of finding owners who are interested in selling their property.

Your analysts can use Reonomy’s building and lot, sales, and mortgage data on commercial properties to determine if any of the cases above are likely, and based on that information, the acquisition team can reach out only to pre-qualified leads.

Why connect with sellers off-market?

So then, if identifying the right off-market prospects is so tricky, is this tactic really worth the attention of your firm?

One benefit of off-market deal-making is the ability to take a more personal approach to each interaction. For example, Reonomy allows you to see an owner’s entire real estate portfolio in one place, therefore you can fully analyze their situation and tailor your pitch accordingly.

Another benefit of searching for deals off-market is that your team will encounter less competition from other potential buyers. An owner of a property that is actively listed for sale will most likely be approached by multiple interested parties who may end up in a bidding war for the deal. Off-market owners on the other hand, will not have a bunch of competing offers to choose from, and may be more willing to negotiate or settle for your initial proposed purchase price.

Overall, buying real estate off-market allows much more flexibility. Negotiations can be more fluid, resulting in better deals for both parties. Off-market sellers can maximize their earnings by avoiding broker commissions associated with listing their property with a brokerage. Using a tool like Reonomy will streamline your organization’s acquisition efforts by helping you not only spot motivated sellers of commercial property, but also access their contact information and get in touch with them directly.

Author

Reonomy

Resources team

Author

Reonomy

Resources team