Selling commercial real estate: Helpful tips and tools

Whether you're an owner or broker, selling commercial real estate isn't what it used to be—and that's a good thing.

Selling commercial properties takes finesse. Whether you’re an owner wanting to sell your property by yourself or an agent looking to find investors on behalf of a client, there are a few strategies you can employ to find qualified buyers for commercial assets. In order to find the best deal and close as fast as possible, you need to:

Be a really effective marketer and/or

Have a direct, reliable pathway to identifying potential buyers.

In this article, we’ll show you how to easily accomplish both of these tasks.

Selling commercial real estate

There are three main strategies for selling a commercial property of any kind:

Work with a commercial real estate broker.

Market your property on commercial or FSBO listings websites.

Analyze off-market data to identify likely buyers and connect with them directly.

While the idea of off-market transactions is nothing new, access to off-market data has evolved in recent years. Now, off-market data goes far beyond public records. This data has become a valuable resource for those looking to sell commercial real estate. However, longer-standing, more traditional options such as working with a commercial agent or advertising your property on a listings website are still effective sales strategies. As a matter of fact, you can combine these three different methods to ensure that you can find fitting buyers time and again.

Work with a commercial real estate broker

Most commercial property owners choose to work with a broker due to the complexity of commercial real estate transactions. The paperwork, intricacies, and time needed to close a deal often require an experienced broker’s assistance. Working with a commercial real estate broker has many advantages, beyond just closing the deal and completing paperwork. These multiple, invaluable services make a broker’s commission well worth the cost.

Ensuring a favorable return on your property

An experienced broker will help you price your property right for the current market conditions, saving you hours of research time. Brokerage firms keep up with the current industry and economic trends, as well as any significant recent sales in their area of operation. They will use sales comps analysis to determine a fair but realistic listing price for your building but will allow room for negotiations with potential buyers.

Brokers have an extensive network of contacts

Seasoned commercial real estate brokers have a well established professional network of other brokers, investors, and additional third parties that may be interested in purchasing your commercial real estate right away. Rather than relying only on traditional marketing strategies, your broker can present your property directly to these individuals, thus significantly increasing your chances of finding a qualified buyer quickly. This network is built over time. Brokers have created connections over years – or even decades – in the business. Their connections alone make hiring an experienced broker worth the cost.

Communicating with potential buyers

Your listing broker will also save you a great deal of time and effort by becoming the main point of contact for any inquiries, tour requests, and potential offers from interested parties. Brokers also coordinate and host all property tours and “open house” events. Your agent can even suggest what renovations and staging changes you should consider to make your property more attractive to investors.

Negotiating with potential buyers

Last but not least, your broker will lead the eventual negotiation back-and-forth, as well as the actual closing. This negotiation process can be lengthy, but an expert broker will ensure you get the best possible price for your real estate property. The broker you hire gets paid in the form of a commission after the sale of the property is complete. Therefore, it’s in the broker’s best interest to get the absolute best price for your commercial real estate property.

Typically, the commission is a percentage of the final sale price, usually around 6%. If the buyer also has an agent in the transaction, the commission is split between the two participating brokers according to a separate agreement.

Before hiring a commercial real estate broker to sell your property, conduct due diligence, and ensure you hire the right person. Just like with any other professional, you should check their references, speak with some past clients, and ensure they are dedicated to helping you get the best deal for your property. Hiring the right broker can make all the difference between a quick, profitable sale and months on the market without a buyer.

List your property for sale

Hiring a broker and using a listing service to advertise your commercial real estate for sale are not mutually exclusive options. As a matter of fact, unless a broker has an immense network of connections, they’ll typically list your property on several listing platforms as a part of their marketing efforts. The number of listing services for both commercial and residential real estate has increased dramatically since the early days of the Internet.

Some of the more prominent platforms in today’s marketplace include LoopNet, Showcase, Ten-X Commercial, CREXi, and Commercial Exchange. Additionally, there are many niche sites that focus on specific markets or types of commercial property such as gas stations, self-storage units, or vacant land.

Featuring your commercial asset on these platforms can dramatically increase your chances of finding a qualified buyer. These online listing services have become the best way for investors, tenant rep brokers, and even corporate real estate professionals to find commercial real estate. LoopNet alone generates 39 million total monthly searches by users from the U.S. and around the world.

Most of the notable platforms we mentioned above allow you to create a basic listing for your commercial property free of charge. These listings platforms include advanced listing features or advertising opportunities to highlight your property. However, these options typically require a paid membership or other fees.

It’s also best to list your commercial real estate property for sale on multiple platforms. While experienced real estate professionals are familiar with most of these listing services, they typically favor and frequent only a couple for their everyday property searches.

For sale by owner platforms

While definitely a less common practice in the commercial real estate industry, selling by owner is also an option. Some owners have ample experience with commercial property sales and feel confident completing the transaction without an agent. Others simply want to maximize their proceeds by avoiding the broker commission.

First, it is worth noting that owners can add their commercial properties to most CRE listings platforms without a broker’s help. These platforms do not limit their listings to those represented by brokers. Even if you have to purchase a subscription or pay a fee, the global exposure of your listing to potential investors and brokers will be well worth the cost.

However, there are several websites dedicated solely to FSBO listings. Notable platforms include FSBO.com and For Sale By Owner. You can also advertise your commercial real estate on sites like Craigslist and Facebook, and even the digital classifieds of your local newspaper.

Craigslist, for example, has a special category for real estate sales and has sub-sites for virtually every major city in the United States. Believe it or not, though not widely popular, you can even list your commercial property for sale on eBay.

Find buyers off market

Both brokers and owners also consider other approaches to selling real estate. Identifying prospective buyers through off-market research can be a proactive way to identify potential investors. Many professionals take advantage of local public property records to conduct off-market research. However, public records research is usually reactive research, meaning you have a potential buyer in mind, then turn to public ownership data to analyze their portfolio on a deeper level.

Instead, the Reonomy web app gives you access to nationwide off-market data, allowing you to conduct proactive research. This process allows you to discover new contacts likely to buy your commercial property. There are a couple of ways to approach off-market searches for potential buyers.

Review real estate comps

Reonomy has a database of more than 20 million sales transactions nationwide, helping both owners and brokers to generate commercial comps for any property. Accessing them is pretty simple.

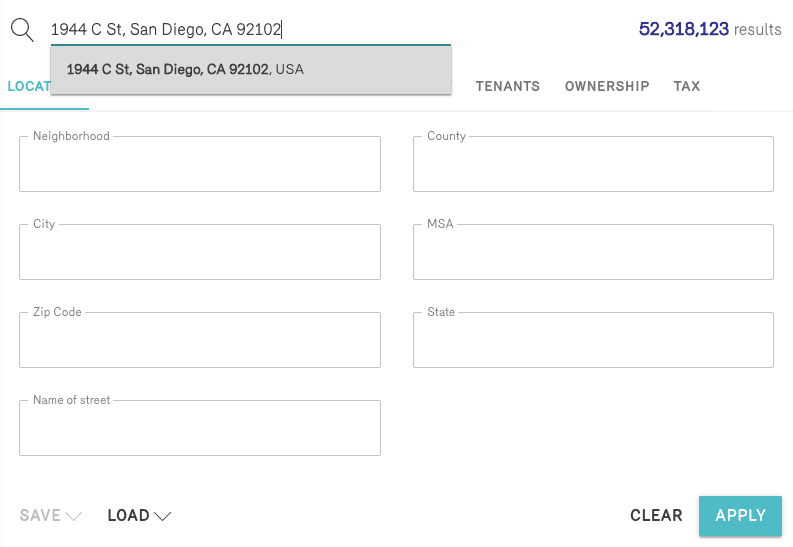

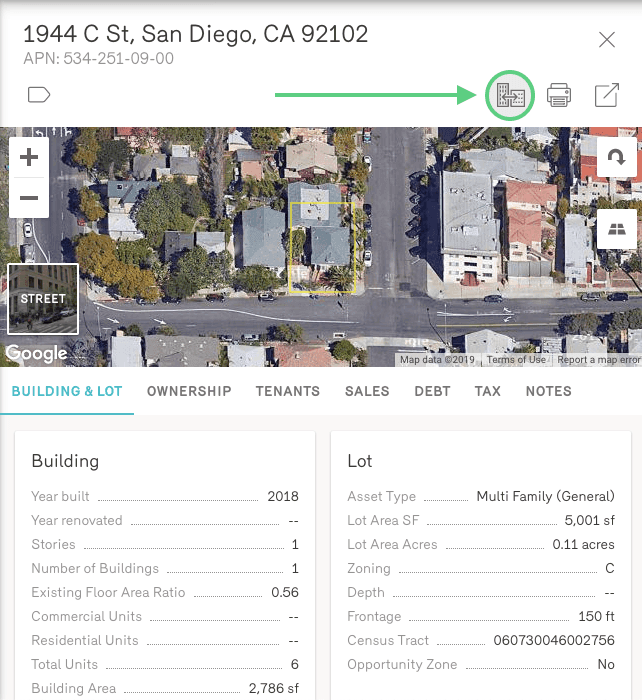

Say you’re a broker looking to find a buyer for 1944 C St, San Diego, CA 92102.

The property is a 6-unit multi family building in Central San Diego with a lot area of 5,000 square feet, and a building size of roughly 2,700 square feet. To find similar properties, start by entering the address in the search bar. Click on the property once it appears in the dropdown:

This takes you to a profile page for that individual property. Then, click on the “View Comparables” icon to access a list of similar assets.

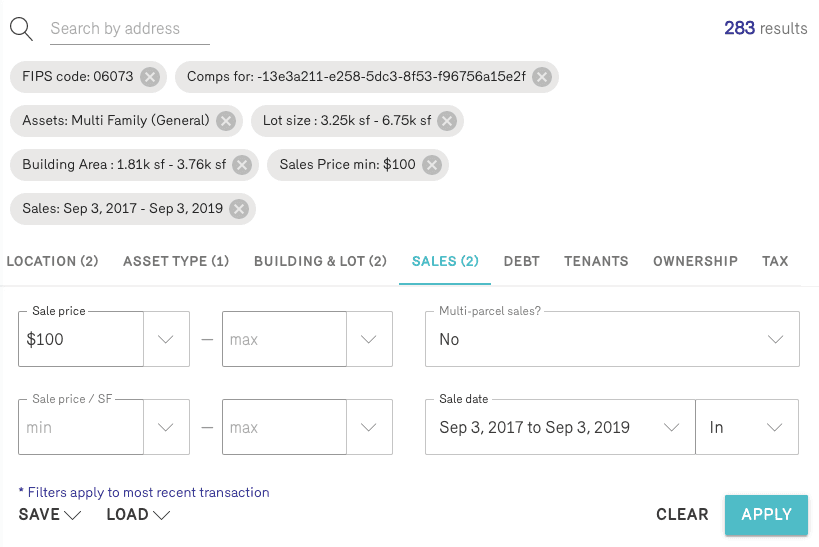

In this case, there are nearly 300 commercial comps. Each is curated based on several filters automatically added by Reonomy.

That’s almost 300 property owners that may be interested in buying another property similar to one they already own. You can continue reviewing these properties individually to better understand the owners and their portfolios, determine if they have cash on hand, and so on.

Find recent buyers and sellers

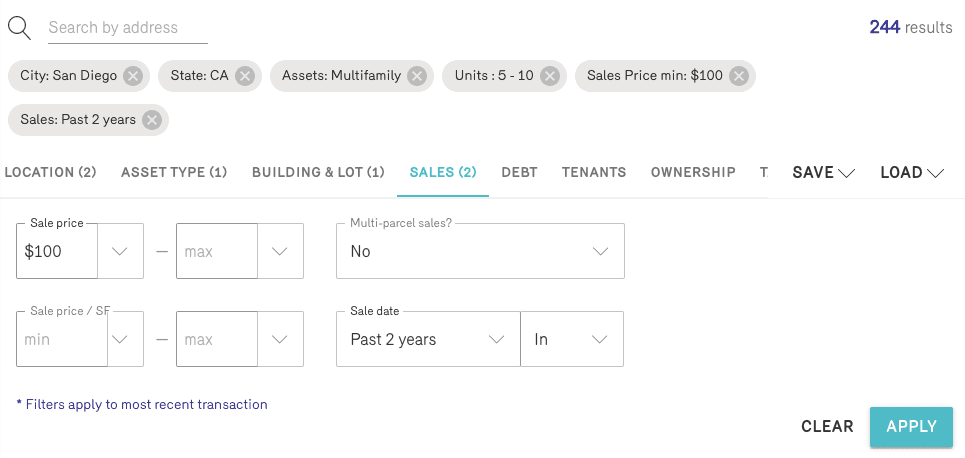

Speaking of cash on hand, another way to sell commercial real estate off-market is to find recent buyers and sellers of similar assets. You can start a property search using location, asset type, and building and lot filters, or simply run a comps search using your subject property (as demonstrated above). Then, filter the results by “most recent sale date” in order to only see properties recently sold.

From here, you can review the ownership details of any individual property, including the names and contact information of LLC owners.

Recent buyers may still be actively looking to expand their portfolios with similar properties. Recent sellers may have cash on hand from their recent sale, and therefore may be looking to reinvest that capital in a new property.

Learn a bit more about what you can find off-market in this video:

Once you have identified these property owners, or identify those who have recently sold commercial properties, you can contact the owners directly and start a conversation. Using the knowledge you’ve gained from researching their portfolios, you can better prepare a pitch and strike a deal. Do you want more information about researching off-market properties? We would be happy to help. Contact us for more information about off-market research and commercial real estate sales.

Author

Reonomy

Resources team

Author

Reonomy

Resources team