Commercial debt and lender analysis

Finding actionable commercial loan and lender insights with Reonomy data.

It can be difficult to maintain a steady and efficient inflow of insights for any commercial lender. Commercial real estate debt information and insights can be among the most elusive to find in the industry.

On this page, we take a look at everything you need to know about finding loan and lender-related insights on multi-family and commercial properties. We’ll also look at how you can utilize those insights to grow your business, understand lender and borrower portfolios, and analyze competitors in-depth.

Commercial real estate loans overview

For lenders and other CRE professionals, there are a plethora of insights that can be derived simply by looking at the current and past loan information on a commercial property.

Reonomy is helping to connect the data required to understand commercial lender and borrower portfolios, so organizations can more quickly analyze and understand prospects, competitors, and the market as a whole.

How to find loan insights on a property

There are two delivery methods for Reonomy data. One is simply to use the Reonomy app and filter through the market.

The other is to incorporate Reonomy data directly into your existing database—leaving your existing internal database more layered, better connected, though undisturbed.

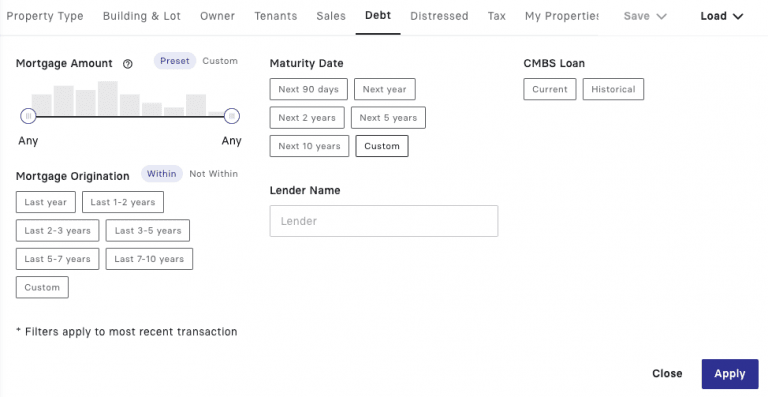

When using the Reonomy app to identify new business opportunities, you can search through your market for any commercial asset type, then filter results by:

Date of last sale

Current mortgage amount

Loan origination date

Loan maturity date

Mortgage lender

In a few steps, you can analyze the present and past debt standing of a commercial asset and its owner.

Current mortgage information

For example, you can identify properties that have a mortgage maturing in the near future (say, the next 90 days, 1 year, 2 years, or more). Or, you might want to look at properties with a loan that originated 5-7 years in the past, since that is the most common holding period for a commercial loan.

The Reonomy web app also allows you to see, in real time, properties in any market that are currently in pre-foreclosure, with the stage of pre-foreclosure that it’s in. These searches make for a quick list of commercial owners that’ll be looking to refinance in the near future.

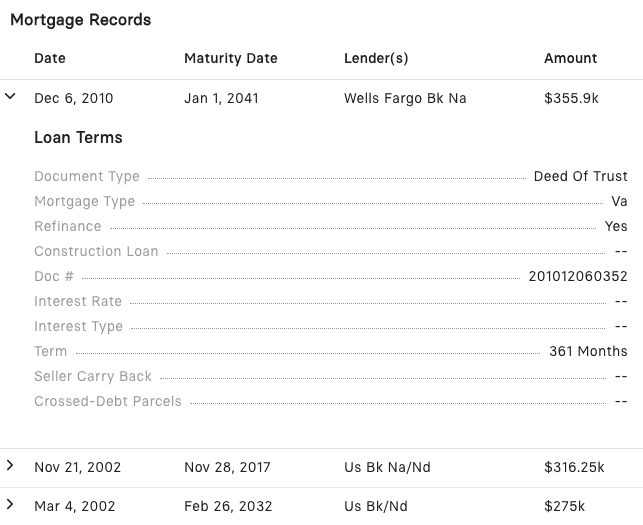

Mortgage history

You can conduct more thorough analysis to determine the likely intentions of the owner, as well.

When analyzing the present and past mortgage information on any individual asset on Reonomy, you’ll be able to see the following:

Mortgage Origination Date

Mortgage Maturity Date

Lender

Amount

Document Type

Document Number

Mortgage Type (including whether the loan was a construction loan or refinance)

Interest Rate & Type

Loan Term

Seller Carry Back

Crossed-Debt Parcels (including how many, as well as the parcels themselves)

Signatory Name and Role (for example, an LLC “member”)

You can pair these insights with owner details and contact information (all within the Reonomy app) to reach out directly to property owners and connect with them at the exact right time.

The insights you’ve gained give you the competitive advantage of knowing what to pitch an owner on and when.

How to identify refinance leads with property intelligence

If you’re a lender or originator, in most cases, you’ll be looking to analyze properties in bulk in the efforts to build a list of refinance leads. With access to property intelligence on Reonomy, you can quickly identify loan leads that fit a tight set of characteristics, and use that list as your list of leads to reach out to.

With those characteristics, you can quickly discern those in need of refinancing. Let’s run through an example of how you can identify refinance leads with property intelligence… First up, of course, is to locate your market and filter out any asset types you’re uninvolved with.

Adding a property location

Within the Location section of the app, you can narrow down results to a specific state, city, MSA, county, zip code, neighborhood, or street (or any combination of those).

You can also search for an exact address in the top-aligned bar if you already have a property in mind.

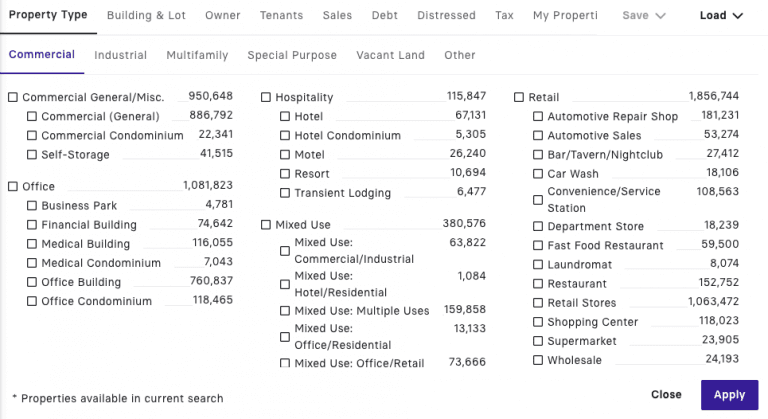

Adding an asset type

Say you are searching within Mecklenburg County, North Carolina, and you’re looking only for multi family properties that need to refinance.

Not only can you search generally for “All Multifamily,” but you can pick and choose from a number of multi family property sub-classes to narrow down your results.

That goes for all major asset types—including general commercial, office, retail, mixed-use, hospitality, healthcare, industrial, land, and more.

Once you’ve added at least one filter for your desired asset type, you can navigate over to the Building & Lot tab to add specific qualifications for building and lot size, age, and whether or not the property is in a Qualified Opportunity Zone.

From there you can move onto the Debt tab to begin adding specific mortgage and lender filters.

Look at properties with specific loan origination dates

This is where the real juicy insights can be honed in on. To reiterate, let’s say you’re still searching for multi family prospects in Mecklenburg County, NC.

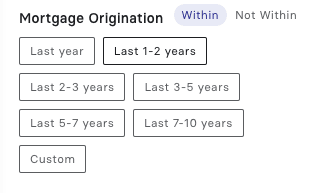

You can search for multi family properties in Mecklenburg County that have a loan origination date that did or did not occur within a specified time range.

Default choices allow you to search for originations that were in the last 1-2 years, last 2-3 years, last 3-5 years, last 5-7 years, last 7-10 years, or you can add a custom range of your choice.

The typical holding period for a commercial loan hovers in the 5-7 year-range, and so many mortgage brokers and lenders use this to find refinance leads.

See loan maturity dates

Instead of searching by origination date, you might also choose to search by a loan’s maturity date, given it is a more finite value. When searching by maturity date, default searches are for loans maturing in the next 90 days, one year, 2 years, 5 years, and 10 years.

Here, you can again add a custom date range if preferred. In either of the above cases, you can compile a list of many properties that have maturing loans or loans originated in a date range.

You can export that list with owner contact details included, and use it to generate new business for your organization.

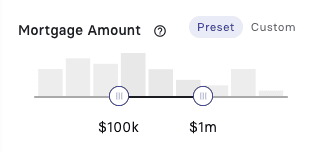

Filter properties by the size of loan

You’ll, of course, be interested to see properties that garner a specific size of loan. Use Reonomy Debt filters to add a price range, or to add a minimum or max to your loan amount. Default dollar amounts to choose from are $100k, $500k, $1m, $25m, and $100m. You can also input a custom amount if you prefer that.

Find leads working with a specific lender

Lastly, you can also search for properties based on the most recent mortgage lender. If there is a particular lender that you’d like to target competitively, you can identify properties that have loans with that lending entity.

For example, say you’re a competitor of the hypothetical “Bank ABC.” You know that you can currently offer better rates on similar assets to that of Bank ABC. Use Reonomy to search for properties that have loans with Bank ABC originated 5-7 years prior—you can reach out directly to the owner and pitch your more favorable rates, prompting them to refinance with you instead of Bank ABC.

To really bring your analysis home, you can analyze property sales history and property sales records, which are easily filtered for and appear in every property details page in app.

Finding liens on a property

Before investing in a property, conduct a property lien search to determine if the state or federal tax collection agencies have placed a lien on a property. A lien outside of normal property debt indicates an owner might owe back taxes on a property.

Contact the county clerk’s office where the property is located to inquire about state or federal tax liens.

You can provide the name of the property owner that you sourced from the Reonomy platform in order to request the information about the tax lien from the government.

Spotting assets in distress

A distressed property is an under-performing asset that provides a challenge to the owner either financially, physically, or legally. From a buying standpoint, identifying a distressed property can work to your advantage, as most of the issues can be turned into advantages.

To find distressed properties, you can use online listing tools. You can also use Reonomy to find distressed properties by utilizing the search filters for finding properties that are currently in pre-foreclosure.

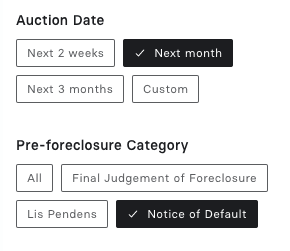

You can either search by “Auction Date,” or, “Pre-foreclosure Category.” You can search for pre-foreclosures with an auction date within the next two weeks, one month, or three months. You can also instead enter a custom auction date range.

When searching based on the pre-foreclosure category of a property, you can choose from “All,” “Final Judgement of Foreclosure,” “Lis Pendens,” and “Notice of Defaults.”

Once again, when looking at properties in pre-foreclosure, you can access the ownership and contact information for those properties to reach out directly and make a move.

Reonomy provides a range of other data points that can indicate distress, as well.

An example of this, is if you determine a mortgage amount is much too high for a property, likely producing a negative cash flow.

Overview of commercial loan types

There are a mixture of loan types from traditional, fixed-rate loans to bridge loans to mezzanine financing.

Commercial property loans, or a commercial mortgage, is an essential planning step as an investor.

What type of loan is appropriate, calculating the amount of the commercial loans, finding a commercial lender, and understanding the risk on your loan are all essential to planning an investment, whether as an individual investor or a company.

While Lenders and Debt brokers likely already know what would be appropriate, understanding risk and potential is an important step to take.

Here is a quick overview of some commercial loan types:

1. SBA loans

There are two types of SBA loans that are generally of interest to commercial real estate investors: SBA 7(a) loans and SBA 504 loans. Both target new and existing businesses looking to purchase or refinance owner-occupied commercial real estate.

2. Mezzanine financing

Mezzanine financing is often used to fill the “middle” of a capital stack. It can be structured in a number of ways, including both debt and equity. For instance, it can take the form of junior debt – such as a second mortgage on the property.

It can also be structured as preferred equity, convertible debt or participating debt.

3. Hard money loans

Hard money loans are an alternative form of capital, provided outside of traditional lending channels, either by individuals or companies. These loans are usually secured by using commercial real estate as collateral.

4. Commercial bridge loans

A commercial bridge loan is a source of short-term capital that is often used for debt service until an owner improves, refinances, leases, sells, or otherwise completes a property transaction.

5. Traditional fixed rate mortgage

Most real estate investors purchase property using traditional, fixed-rate mortgages. These are similar to the types of loans you’d get when purchasing a home.

Lenders typically require a 25% down payment (minimum) in exchange for a fixed-rate mortgage ranging from 7 to 30 years.

6. CMBS loans

Commercial mortgage-backed security (CMBS) loans are a type of popular commercial real estate loan secured by a first-position mortgage for a commercial real estate property. They are offered by conduit lenders, as well as investment and commercial banks.

Author

Reonomy

Resources team

Author

Reonomy

Resources team