Commercial real estate comps

Informing a better understanding of commercial real estate markets and owners.

There’s a great deal of insight that can be derived from analyzing comparable properties and situations to one you might be involved with today.

This page details real estate comps thoroughly—first giving an overview of how comps are generally used in CRE, then later showing how you can actually find comps to take your strategic decision-making to the next level.

Benefits of commercial real estate comps?

Real estate comps are a great way to ensure that you’re making sound professional commercial real estate decisions. Leasing comparables help investors assess the potential ROI of a property versus its peers, while sales comparables help identify recent sales of properties very similar to that of your subject property.

Comps present a way to dive in and hyper-analyze a property and its relative market with the help of real, relevant data. Real estate comps are the best way to value a commercial property, and are also a tremendous way for commercial real estate professionals to identify new opportunities.

Determining commercial property value

Most professionals that utilize commercial real estate comps do so to understand the market value of an asset. It gives them the ability to harness recent historical data of properties with similar characteristics, in similar markets. Comps are also relative to every individual market, making them a very accurate way to find the current market value of any asset type, in any market.

Identifying new commercial real estate opportunities

Real estate comps can also be used to search for new opportunities. If commercial real estate professional is familiar with a property’s potential business value to them, they can analyze comps to identify opportunities of similar value and spot areas of expansion in the market.

For example, an investor can take a property that is already apart of their portfolio and run a comps search on that property to find other properties that they may want to pursue. A roofer could view comps of a property they recently renovated to find others of similar sizes and values. A sales broker could view comparables of a recently sold building in their market to quickly approach other nearby owners off-market. The list goes on…

How real estate comps are determined

Historically, real estate comps were driven primarily by property sales history. Today, however, there are many different data points compiled to generate an accurate property comp. Advanced tech platforms like Reonomy allow for all kinds of property data to be aggregated and used when creating comparables. So, while sales history is still the main driver, Reonomy real estate comps are also compiled using layers of property, building, and transactional data. Other than an asset’s location, examples include property type/sub-type, price of last sale, debt history, and much more.

1. Commercial property sales history

We should clarify, without property sales records, real estate comps would not be possible. To provide accurate real estate comps, Reonomy looks at the full sales history of a property, notably its most recent sale. Analyzing an asset’s previous transactions helps you understand its value over time, if that value is changing, and exactly how it is changing. The more recent a sale price, the more comparable that price will be to the current value of a similar asset. Furthermore, properties that have similar trends in their sale history are likely under similar surrounding conditions.

2. Recently sold commercial properties

Recently sold property data overall is great fuel for real estate comps. By looking at targeted comps that have been sold recently, you can better understand the shape of the current market surrounding those properties, beyond the individual properties themselves. Property sales history data across comps can help you better understand the market conditions surrounding your target asset.

3. Property location

Real estate comps are also derived from the locational comparability of two properties. In other words, are the comp assets and your target asset under the same locational influences? Simply enough, for this, Reonomy derives real estate comps from properties that fall within a similar area—usually very nearby the target property. Property location data paired with property sales history data creates a clear picture of how real estate professionals are interacting with certain types of properties, and the potential influences that could affect the way they do so in the present and future.

4. Building-level data

Real estate comps are also based on the physical characteristics of a property. The asset type, building size, lot size, condition, and age of a commercial property will play a large part in determining its value, making it important to identify properties that are structurally comparable to your target. Overall, the data used to generate Reonomy real estate comps helps users find properties that are under the same market conditions, are locationally comparable, and physically comparable to that of your target.

How to find real estate comps

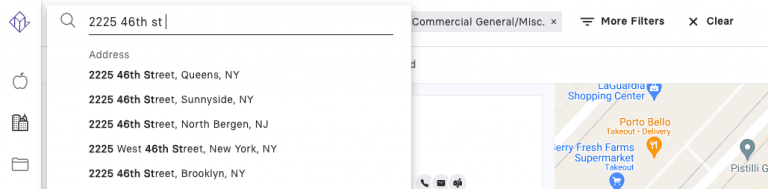

Traditionally, commercial real estate comps could be found by scouring through public property records and compiling data to analyze. Reonomy helps identify properties with similar data points to the property of your choice. The only information you really need is the address of the property. Enter a subject property that you want to see comps for:

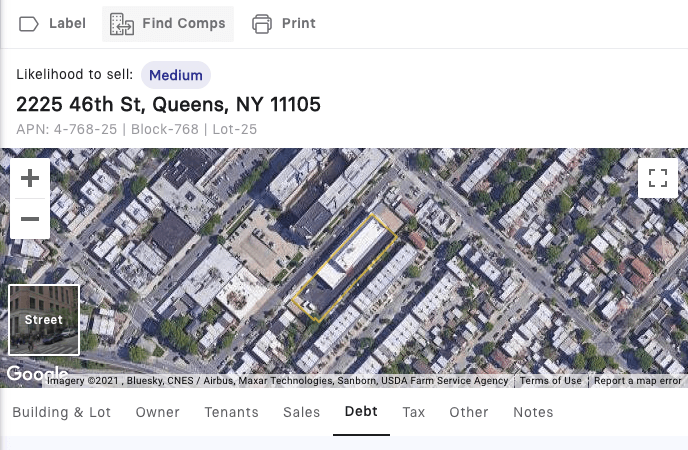

Just type in the address and you’re on your way. Whether you looked up the address of a known property directly, or found the property based on a set of search criteria, finding comps is as simple as clicking the “Find Comps” button that sits at the top of any property profile page.

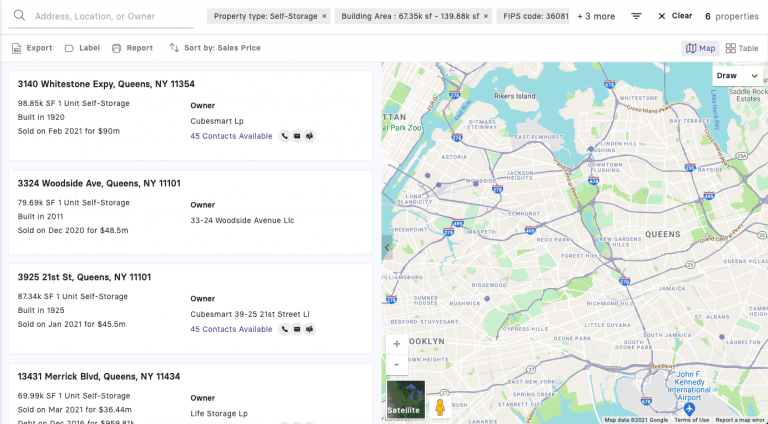

That button will bring you to a new list of properties that all fit very similar criteria to that of your origin point.

Once you’ve generated a list of comparable properties, you can also continue filtering your list to weed out certain results if needed. Below, we’ll cover some more clear-cut examples of common comp searches across different asset types and geographies.

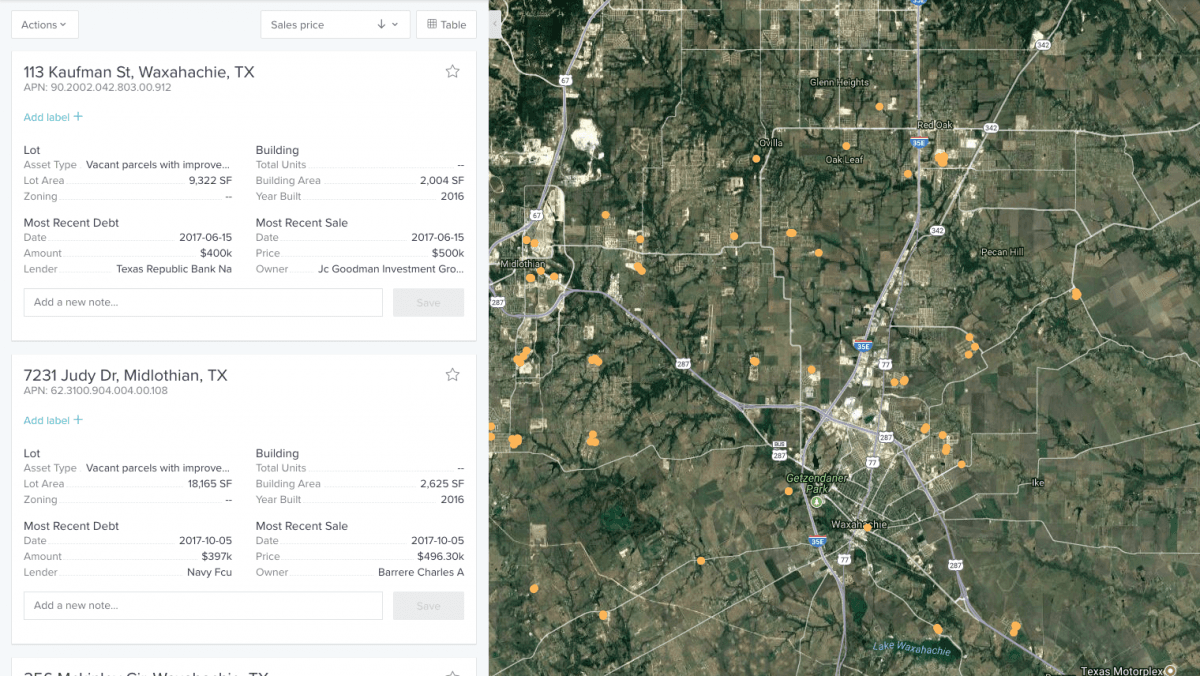

Land comps

To find land comps on Reonomy, you can search by parcel details like lot acreage to find comparable plots of land. You can also identify comps for more specific land sub-asset types. You can find comps for farm land, commercial vacant land, industrial vacant land, residential vacant land, and more.

Multi-family comps

Multifamily comps can also be identified factoring in a variety of filters. As mentioned with land comps, you can search more specifically for different types of multifamily properties, by classifications such as apartment buildings (specified by units), duplexes, triplexes, mobile home parks, nursing homes, and more. You can then view properties by their building area and number of units, for example. Once you’ve added a few layers of filters, select any individual multifamily property and use the “Find Comps” button to see comparable properties in a specific area.

Example

Below, using Reonomy, we search for a Quadruplex property in LA County built in 2016, then jump into an individual property profile and click “Find Comps.” At this point, you’ll be given a list of properties to analyze—a list that can be filtered even further. For example, from that list, you can filter the properties using a zip code within LA County. By adding the “90007” zip code to our search, we’re left with much fewer properties to search through—properties that fit within a more confined space, under more similar locational influences.

Comps by zip code

Adding a zip code filter is a good way to limit the area of search. It’s also helpful to add filters for specific building data or asset class within that zip code. To get hyper-granular, you can add filters for most recent sale price, zoning information, and so on. Let’s look at a few example searches of how you might identify asset-specific commercial real estate comparables within different locations.

Example: Industrial comps in Chicago

Below, we search for an industrial property in Chicago sold within the past 20 years. In Reonomy, after we have selected the property we want to find comps for, we simply press the “Find Comps” button. We then filter the comparable property list within a particular area code of the Chicago area—60651—and return only two properties with comparable value.

Find comps by sales history

Sales history is a significant determinant of a relevant comp. By finding recently sold commercial properties that have similar physical characteristics (i.e. location, asset class, square footage, acreage, units, condition, age, and on) to that of your target property and analyzing their sales history, you can better understand the value of your target property. You can easily discover properties based on their sales history breakdown.

For example, by searching for commercial properties that have been sold within the last year for anywhere in between $500,000 and $700,000, you can get a very fresh idea of what that amount of money could get you today. By utilizing the sales tab of Reonomy’s search page, you can search by most recent sale date or most recent sale price.

Once you’ve done that, simply enter a property profile page, click the “Find Comps” icon, and you’ll be well on your way. While these filters do work on their own, they are best used in unison with one another. Instead of simply searching for “multifamily” or for properties within “Chicago,” you can instead search for “multifamily properties in Chicago that have sold in the last year for $500,000 to $700,000.” Doing so will garner much more specific results, and will thus return incredibly useful, incredibly accurate real estate comps.

Author

Reonomy

Resources team

Author

Reonomy

Resources team