Off market properties

What off market means, its benefits, and how to search off market properties.

A very large portion of commercial real estate analysis and transactions are now taking place off market. The number of businesses that prefer to do so continues to grow, and with good reason.

Throughout this page, we’ll look at how you can unlock a new world of business opportunities just by having access to off market data. We’ll also look at why having access to off market data online is better than utilizing public property records of any kind.

If you’re already familiar with off market properties and want to start searching the most robust database in the nation, watch the video below.

What does off market mean?

Any property, research, or transaction that is “off market,” is that which does not happen through the active, public market.

The term seems vague, but it’s not entirely so—it just encompasses a lot. You’ll see “off market” used as a descriptor for three different things:

Properties

Research

Transactions

Off market properties are those that are not currently advertised publicly for sale—a synonym being, “unlisted properties.” Given the fact that only a certain amount of properties are listed for sale, at any point in time, the pool of off market properties will be substantially larger than those on the market.

Off market research is any analysis that takes place via access to off market data.

That might entail research you conduct through public records, or say, on the Reonomy app. We show a thorough example of this further down the page.

Off market deals are CRE transactions and business agreements initiated and finalized in completely private, exclusive manners. No advertisements, and sometimes, no third-parties whatsoever. So, in pairing your existing relationships and expertise with a property intelligence platform like Reonomy, off market deal-making opens a new world of opportunity for you and your business.

Off market vs. on-market

Sometimes, the easiest way to define the meaning of “off market,” is simply to define what it isn’t.

On-market properties are those actively and publicly advertised for sale. They’re listed on real estate listings platforms, and advertised elsewhere (including social media, newspapers, and more) either by an agent or the owner. The largest commercial property listing platforms typically won’t have more than a few-hundred thousand listings at one time. The thing is, there are more than 50 million commercial properties in the US.

So, at best, even the largest commercial listings website would only have about 1% of the total supply of non-single family assets.

Having access to off market data (with Reonomy) means you have access to data on almost every commercial asset in the country—whether they’re currently listed for sale or not.

“Off market properties for sale”

One of the biggest misconceptions with regards to off market properties is that they’re actively for sale, but simply not listed. While that can be the case, a property that is off market is not always for sale. An owner of an off market property might be willing to sell, but that doesn’t mean they’re trying to sell. They’re approachable, but not eager. It’s also important to consider that off market properties are interacted with in many other ways than just sale transactions.

All kinds of professionals, including brokers, investors, appraisers, roofers, cleaners, and lenders can, and do, conduct business off market.

Let’s look at how.

What are the benefits of off market?

Approaching an owner off market means that you are reaching out to them before they’ve made their needs/wants deliberately known.

In other words, for different professionals looking to conduct business with property owners, this is a way to uncover otherwise hidden opportunities.

Maybe they have an old building but aren’t actively seeking contractors to renovate the property yet.

Perhaps they’re in a storm path and aren’t sure if they’ll need a contractor.

Maybe an owner hadn’t thought much about refinancing, but upon being offered lower interest rates, would be interested to have the extra cash on-hand.

Additionally, an owner might be willing to sell without actively seeking it a buyer. And even if an owner hasn’t thought much about selling, when it comes to off market deals, of course, everything has its price. When searching on-market, if a buyer is interested in purchasing an asset, they’ll have to haggle based on the listing price, and will communicate through an associated broker.

Translation: They’ll likely pay more than they could have, while interacting with additional third party motives.

Interestingly enough, though, off market deals don’t spell bad news for brokers.

Brokers themselves can go off market as a means of prospecting properties likely to sell—simply getting to those properties before anyone else does. There’s complete freedom and customizability when it comes to searching off market, however, which allows the benefits to be spread amongst a wide selection of professionals. The benefits of off market serve property buyers perhaps more than any other group.

Here’s why:

1. Access to unlimited properties

Your property search doesn’t have to be limited only to what’s available on the market. With such high levels of data and information accessibility, there’s no longer any reason to do so.

Reonomy, for example, has taken the meaning of off market to new levels by creating a platform where no property is off-limits.

The idea? Just because a property is being listed publicly doesn’t mean its property and ownership details cannot be searched off market (more on that later). Using Reonomy allows you to grasp the full potential of off market properties, while sourcing properties that fit into your exact investment specifications. It’s good to use listings services to identify target properties, or what your target property should look like. You can use these platforms to understand market values, and compare properties for sale to the full universe of properties on Reonomy to validate what a fair deal would look like.

See listings platforms by asset type:

Multifamily

Duplex

Land

Warehouse

Apartment buildings

Mobile home parks

Retail

Office buildings

Hotels

Accessing off market properties on Reonomy means accessing the entire supply of U.S. commercial properties. Your search for new business becomes almost limitless.

2. Less competition

Since listed properties are limited, the amount of eyes on each property can become overabundant—especially when it comes to commercial properties. Searching and sourcing deals off market also allows you to avoid the competition of other buyers. This rids of competition-driven price hikes, while also giving you more freedom in negotiating a selling price.

3. Save money on fees

Without the need of a third-party, you’ll also be able to avoid broker fees and other fees that come along with acquiring a commercial property. Mass-marketed listings regularly command a premium of 30% compared to off market, which is the equivalent of a down payment. Striking a deal off market allows you to save quite a bit on an investment, while still allowing you to pay the owner a price that they desire

4. Better understand property owners

Another perk that comes along with finding properties off market is the ability to control what you see with regards to any single property and its owner. When going through listings and a broker, a property is being advertised—therefore the information you’ll be privy to could be limited and presented in ways that favor the seller. Searching off market is completely open-ended, giving you complete freedom and customization over the properties you find and the information you choose to analyze on those properties.

It really is customizability to the highest degree.

Ownership details and portfolios are readily available on Reonomy, as well.

You can take your off market search one level further to understand the fine details of an owner’s portfolio and individual properties to prepare for eventually reaching out to them.

There are various data points on any property that you can analyze to better understand individual owners before reaching out to them. Property sales records, for example, show what the current owner paid for the property and when they purchased the property. What the owner paid for the property is a factor to consider when inferring what they’d expect as a return. How long they’ve held the property can signal their willingness to sell. If approaching the property owner, this information equips you to tailor your pitch to them.

5. Connect and negotiate directly with property owners

Use the benefit of avoiding broker fees as well as contact information from Reonomy to negotiate directly with owners. Connecting with an owner directly can benefit all parties involved.

How to find off market properties

Reonomy has the largest database of off market properties in the nation. You can easily identify the opportunities that fit your preferred criteria with hundreds of applicable search filters.

Reonomy off market properties

Reonomy’s property intelligence app gives you access to off market data on more than 50 million commercial properties nationwide. You can discover properties and owners in many ways on Reonomy.

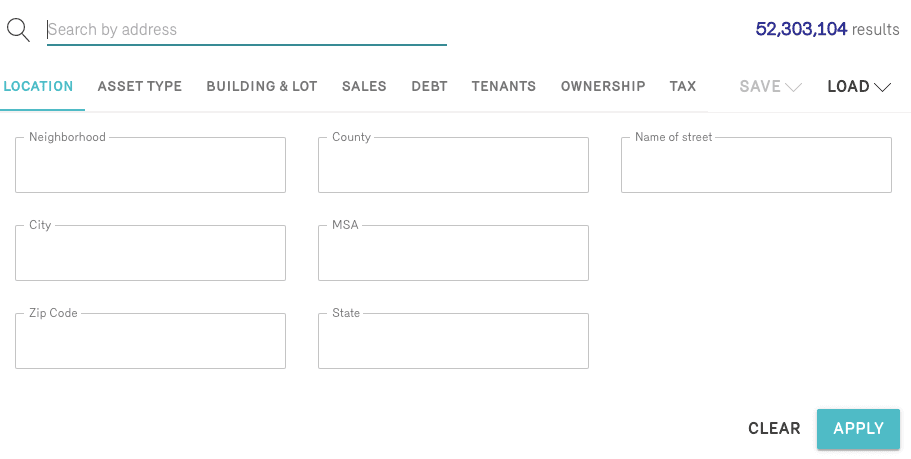

Search Properties by Location

Search off market properties based on location as broadly or specifically as you need—by state, county, city, zip code, street address, or Opportunity Zone.

You can also select a radius on the map to search for any properties within a particular distance from a single location. Or use the draw tool to identify a specific neighborhood or target multiple specific areas within the map.

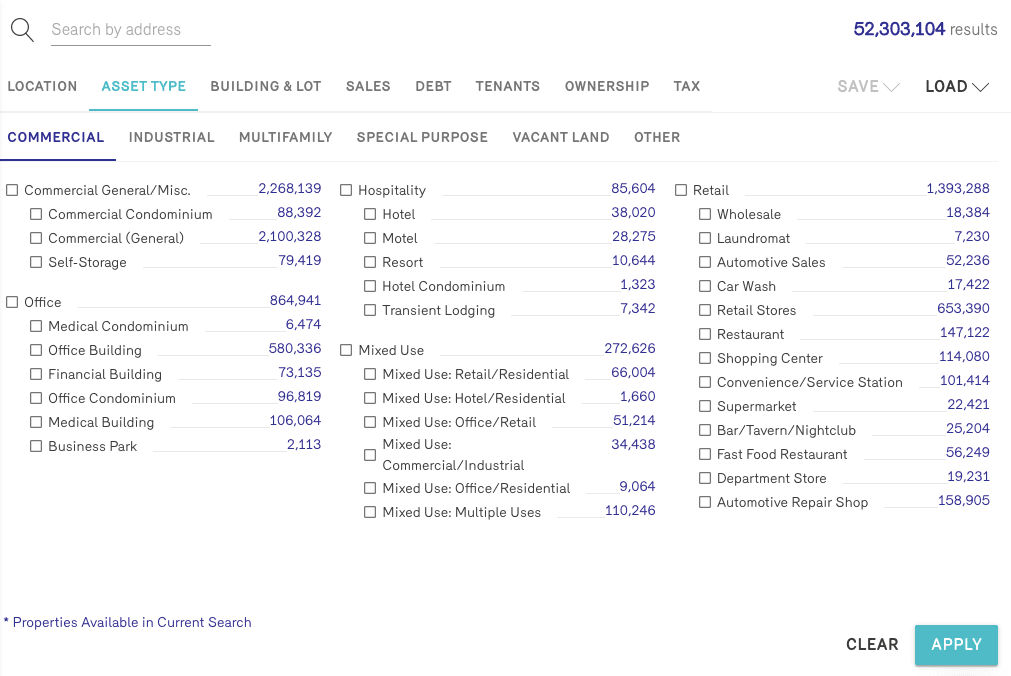

Search properties by asset type

Search off-market for any commercial asset type, including duplexes and other multifamily properties. Looking for all multifamily properties in Texas? Filter your search quickly and easily.

Add filters by state, county, or zip, along with various levels of multifamily property filters. Search everything from duplexes, to mobile home parks, to student housing. Search as specifically as “gas stations,” or as broadly as “all industrial properties.”

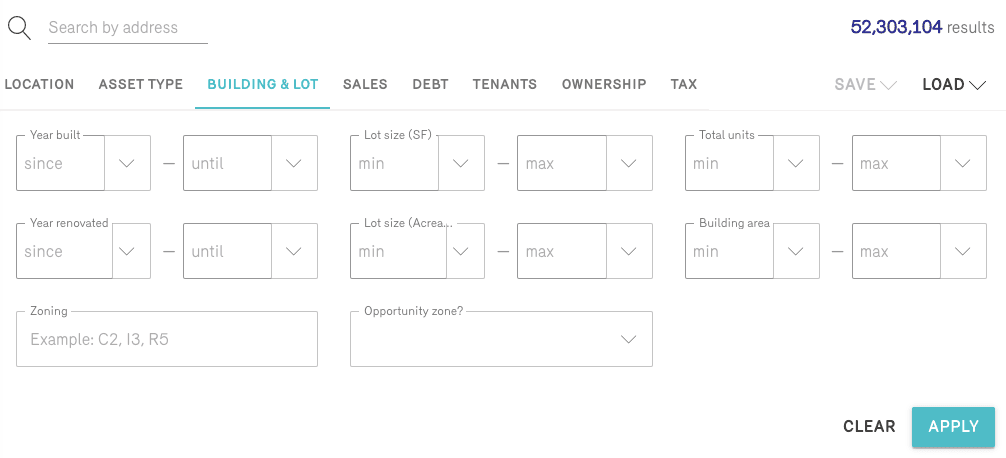

Search properties by building and lot characteristics

Search commercial properties based on their building and lot size, age, and zoning specs.

Perhaps you’re a roofer looking for a property with a specific building size. Maybe you’re a repair company looking for older warehouses. Maybe you’re an investor looking for an apartment building with a certain number of units. Whatever the case may be, you can filter your off-market property search by your preferred building and lot size and age.

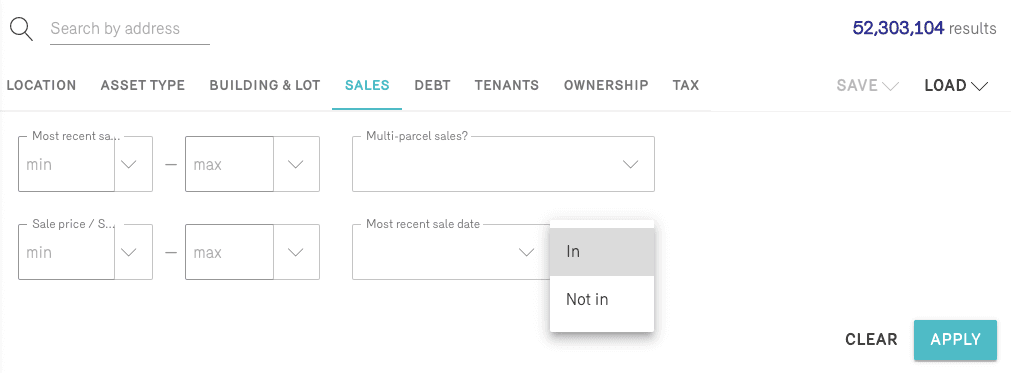

Search properties by sales history

Identify properties by date and price of last sale.

Filter your searches by properties sold within a particular time period, or that haven’t been sold in decades. It is easy to filter for properties that have not transacted in 5, 10, or more years. Identify groups of properties with specific sales history criteria, of a specific asset type, in any market, in a matter of seconds.

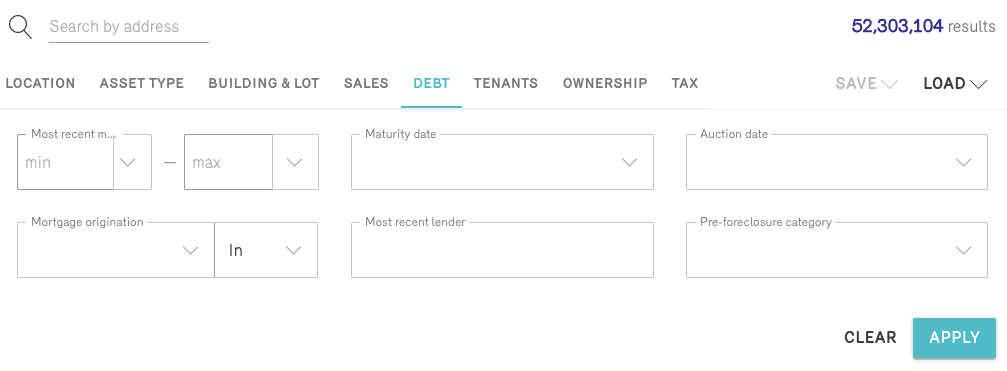

Search properties by debt history

Search off-market commercial real estate data by mortgage dates, amounts, and lenders.

Uncover mortgage information on any commercial property nationwide, including mortgage origination and maturity dates, most recent mortgage amount, and most recent lender. Dive in even further to analyze full lender portfolios. Filter for properties from a specific lender, or that have an origination date that is likely coming to term in the next year. Use your insights as a commercial mortgage broker or lender to filter searches to best identify opportunities.

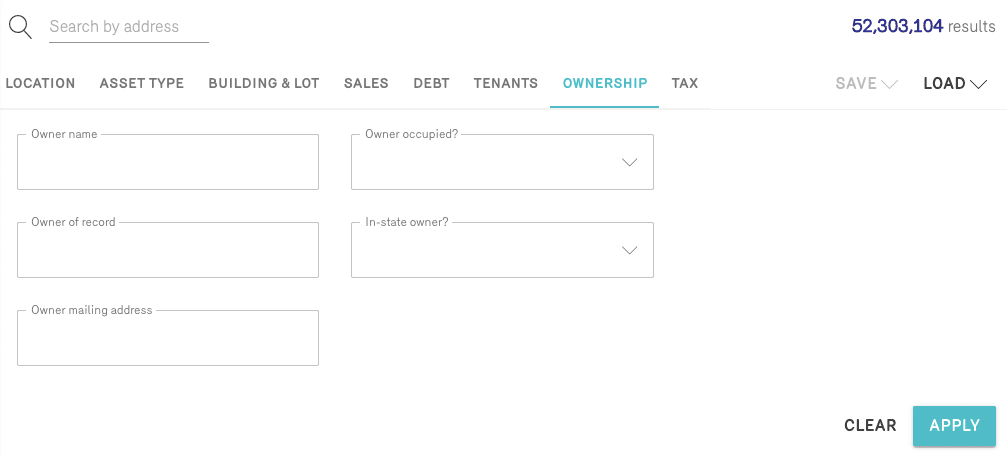

Owner portfolio search

Search off-market for specific LLCs or owning individuals.

Ownership portfolio information is easily accessible and searchable when using Reonomy. If there is a particular owner you are interested in working with, identify new opportunities through an ownership portfolio search. Uncover property details on any off-market property an owner may be associated with.

Search properties in opportunity zones

Search and find commercial properties in any of the 8,762 Opportunity Zones nationwide. When searching off-market properties on Reonomy, you can also filter based on whether or not a property is located within an Opportunity Zone. You can also see whether an existing property of interest is within an Opp Zone, assuring that you’re getting the most out of a potential investment.

How to connect with owners off-market

While it’s great to be able to search and find properties of interest, no deal can ever be made without getting in touch with property owners. With Reonomy, you can also access the contact information of the owning entities and individuals behind any commercial property. Owner contact information allows you to connect with decision-makers directly, instead of needing to go through brokers or middlemen to negotiate a deal. Combining an off-market search with in-depth property and ownership details is all you need for a lifetime of investment success. Getting started takes just a few clicks.

Author

Reonomy

Resources team

Author

Reonomy

Resources team